If you plan to improve your credit score, this might be the most important article you’ll read today!

And here’s why:

Did you know that just a few simple mistakes can decimate your credit score?

Credit scores are one of the most important indicators of your financial health.

Building a good credit history is key to your financial goals.

Like for example getting a million-dollar business loan from your bank can scale your business lightning fast.

If you don’t know exactly what to do regarding your credit score, you can make certain mistakes that can slam it down, and with it, your chances of getting funding to scale your business can go to hell.

And we don’t want that.

With my 25 years as a financial coach and bank expert, I’ll teach you the most common mistakes entrepreneurs and business owners make that lower their credit scores.

So stay till the end because I’ll also show you how to fix these mistakes!

As you first learn more about the factors that impact your credit score, here are eight of the most common mistakes that lower credit scores:

Factors That Affect Your Credit Score

What is a credit score?

A credit score is a three-digit number that allows financial organizations to assess your credit history and evaluate the risk of increasing credit or lending money to you.

Credit Score Ranges

- Poor: 300-579.

- Fair: 580-669.

- Good: 670-739.

- Very good: 740-799.

- Exceptional: 800-850.

Credit scores are based on the data gathered by the three major credit bureaus (Equifax, Experian, and TransUnion).

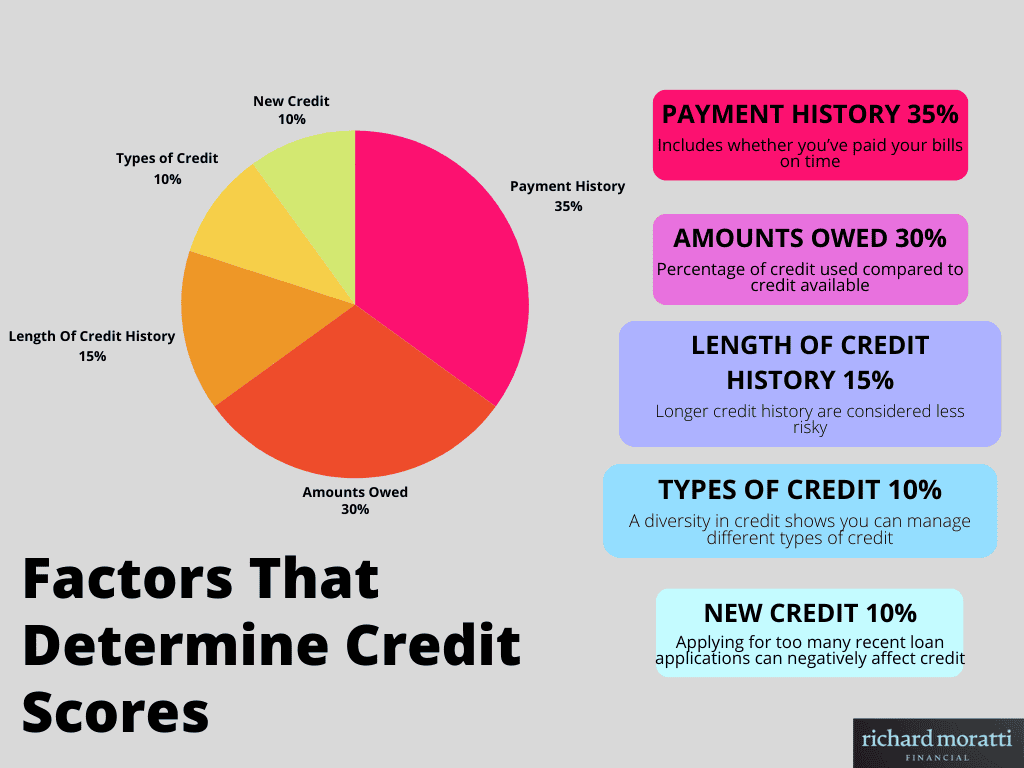

Even though they might differ in the information gathered, here are the five main factors that help calculate a credit score:

Payment history (35%)

The biggest factor is payment history.

Your payment history shows whether you’re responsible enough to pay your bills on time.

It will also show the number and length of late payments you’ve received (if any).

Amounts owed (30%)

Amounts owed is the credit utilization ratio.

It is the percentage of credit you’ve used compared to your available credit.

Length of credit history (15%)

The credit history is based on the time you’ve had the accounts open in your name.

Let’s say you’ve had a credit card open for a long time.

Continuing to use that card responsibly is a great way to maintain a good credit score since longer credit histories are considered less risky.

Types of credit (10%)

Although multiple types of credit are not necessary to maintain a good score, they can still help increase it.

Responsibly using different types of credit, like installments or loans, can show lenders that you are capable of managing your finances.

New credit (10%)

Lenders consider new credit as a possible sign that the individual is desperate for credit.

Applying for credit too often can negatively impact your credit score.

Common Mistakes That Lower Your Credit Score

1. Making Late Payments

The most common mistake that can significantly lower your credit score is making late payments.

Your payment history has the biggest impact on your credit as It makes up 35% of your FICO score.

Even just one late payment on your credit report can cause a decrease in your credit score.

Keep in mind that late payments are not reported to the credit bureaus until at least 30 days after the due date.

And of course, the later the payment is due, the more damage it can do to your credit score.

How To Fix It

- Install an Auto-Pay

- Make Calendar Reminders

- Create a budget plan that works for you

- Ask lenders to adjust due dates

- Check out Debt Management Plans

2. Maxing Out Your Credit Cards

Using your full credit line can negatively affect your credit score. Yes, even if you pay it off every month.

“That’s a bit unfair, don’t you think?”

Well, that’s because the date your balance is reported to the credit bureaus and the date your payment is due is usually different.

For instance, if you have a credit card limit of $3,000 and spend $1,800 during the month, your credit card issuer will report that to the credit bureaus.

Even though you’ll be paying it all off next week, your credit utilization ratio is still 60%.

How To Fix It

An easy solution to this is consulting with your credit card issuer and asking when it reports your balance to the credit bureaus each month.

Pay off all your balance a few days before that date instead of the actual due date.

Try paying it off every two weeks to keep your balance low for the whole billing cycle.

3. Closing Old Credit Cards

It’s tempting to close out old credit cards to keep things organized and simple. However, it’s not always the best idea to do so.

If you’re not in any financial crisis or unable to manage credit, you should always keep your old cards open regardless.

Remember that the length of your credit history compensates for about 15% of your credit score.

Usually, the longer the credit history, the stronger the credit score you get.

Closing out these old credit cards will just lower the average age of your accounts.

How To Fix It

First, pay off all your credit card accounts and not just the one you’re planning to cancel to $0.

But most of the time, it’s best advised to keep the account active even if you’re not using it.

4. Opening Too Many Accounts at Once

Opening too many unnecessary accounts, whether it’s in the form of a loan or credit card in a short amount of time can lower your credit score.

Opening too many accounts at once will make you seem risky to creditors.

Having multiple active accounts will make it more difficult to manage spending and track payment due dates, which can result in another decrease in credit score.

How To Fix It

As we’ve tackled above, it’s still better to leave these credit card accounts open rather than closing or canceling them since it can also hurt your credit score.

You can use these cards now and then as a backup to prevent them from being closed or getting warnings of inactivity from the issuer.

5. Asking for a Credit Limit Increase

Keep your credit utilization ratio low.

If you have a high credit utilization ratio, increasing the credit limit can help.

However, this might not be the best move for everyone.

Banks will need to re-evaluate your financial status before increasing your credit limit.

Generally, requesting an increase to your credit limit is treated similarly as a new application for credit, which results in a decrease in your credit score.

How To Fix It

Before applying for a credit limit increase, consult your banker about their policies first.

If you have a good relationship with your bank, your banker might grant an increase without pulling your credit, and sometimes, you’ll be able to get an increase without even applying.

If you want to improve your relationship with your bank, I wrote an article about the importance and benefits of building a good relationship with banks that you should definitely check out!

Also, keep your utilization ratio below 30%. This will make you more appealing to lenders, suggesting you’re responsible and not maxing out your credit cards.

6. Ignoring Your Credit

Ignoring credit is one of the most common mistakes new entrepreneurs make since they don’t really understand why it’s crucial.

However, monitoring your credit report and credit score is essential for your finances.

Ignoring credit can be the number one cause of not being able to get credit cards, owning property, buying a car, and more.

Check for possible inaccuracies like missing accounts, wrong credit limits, or incorrect Social Security Numbers in your report since it can significantly decrease your score.

How To Fix It

Get a free copy of your credit report annually from the three big credit bureaus: Experian, Equifax, and TransUnion.

You can also check out AnnualCreditReport to get a free report.

Review and look for signs of errors or fraud and report them as soon as you find anything.

7. Living Beyond Your Means

Remember that creditors are not giving you their money for free.

Getting a loan or buying unusual things that you can’t afford can lead to a massive drop in your credit score.

Never borrow beyond your means, as it can cause major financial problems in the future.

How To Fix It

- Review your budget and credit card statements to see if you’re spending beyond your means.

- Create a budget that suits your lifestyle.

- Try to find more income

- Cut back on expenses

- Build up savings

8. Opening Retail Cards for the Discounts or Overspending for the Rewards

As a smart shopper, you might be looking for ways to save money.

That’s why it’s very tempting to say yes to store credit cards or overspending for the rewards.

Who wouldn’t love these cashback and reward points?

Unfortunately, opening too many credit cards at once is a red flag for lenders.

How To Fix It

Instead of looking for credit card promotions, make it a habit of looking for coupons and sales instead.

It only makes sense to get a retail card when you happen to shop at that one store often.

Common Mistakes That Lower Credit Scores: Final Thoughts

Credit score is an essential indicator of your financial health.

That’s why building and maintaining a good credit history is important.

However, to build and maintain this good credit history, we must first understand that certain actions can significantly impact your credit profile.

Avoiding these common mistakes that lead to lower credit scores is a great start to progress.

Mistakes such as making late payments, opening too many accounts at once, maxing out your credit cards, and more can negatively impact your credit score.

The sooner you realize that your credit history can affect your everyday life, the better.

A good credit score can help you achieve your financial goals.