Are you planning to apply for a business loan so you can scale your business?

Taking out a business loan is a great way to cover payroll, purchase inventory, strengthen your business’s cash flow, and more in the shortest amount of time.

However, applying for business loans can be quite confusing and very time-consuming, especially if you don’t know lenders’ typical loan requirements ahead of time.

Luckily for you, I got your back!

I’ll be honest:

Getting the approval for that sweet business loan will be challenging.

But with over two decades of experience as a banking expert and financial coach, I’ll show the exact business loan requirements that you need to know and have so you can be approved almost immediately. .

So here are seven crucial small business loan requirements that you’ll need to prepare:

7 Essential Business Loan Requirements

Applying for business loans can be very frustrating if you’re clueless about what your potential lenders expect from you.

Lenders have different ways when assessing your loan application.

They might have different requirements as well.

As a borrower, it’s your duty to understand and prepare these documents to further better your chances of getting approved for the loan.

1. Personal and Business Credit Scores

When applying for a business loan, lenders will review both your personal and business credit scores.

Lenders review your credit scores since it’s a reflection of your ability to manage or pay debts.

Also, your credit scores can determine your loan amounts.

To be able to qualify for traditional bank loans or government-backed SBA loans, you’ll most likely need good personal credit.

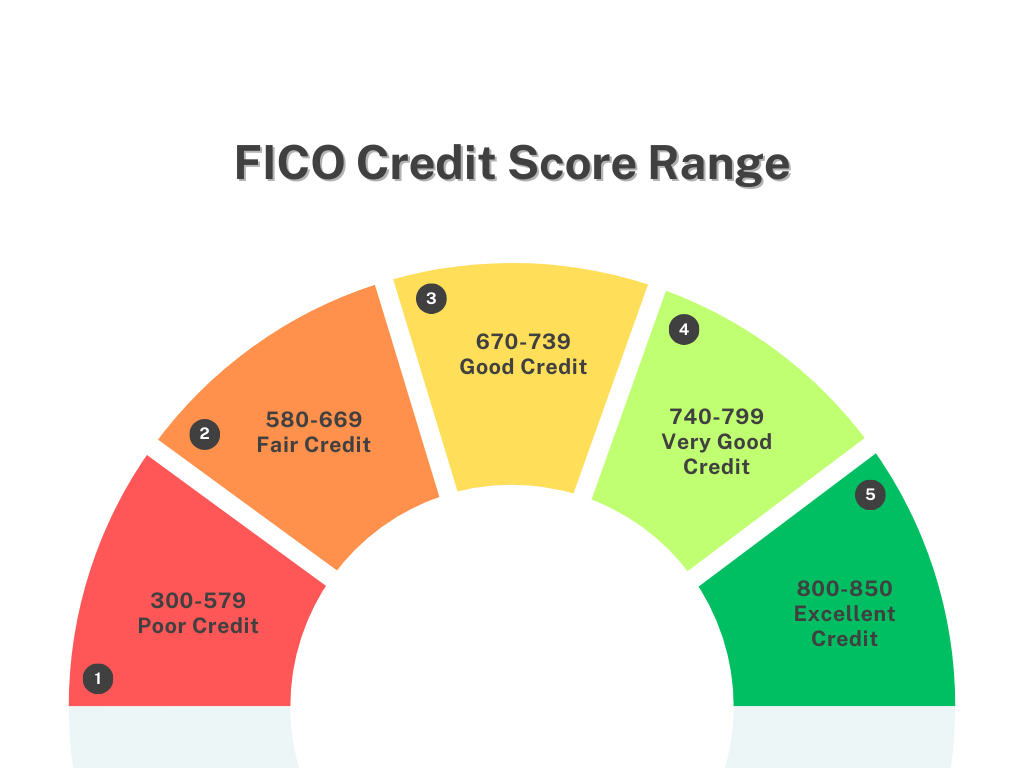

If you’re unfamiliar with credit scores, here’s a quick look at FICO’s credit score range:

FICO Credit Score Range

- Exceptional: 800+

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: Less than 580

As you can see above, a credit score of 670 and above is considered good.

Improving your credit score to good or even to exceptional would be great for your business.

With a higher credit score, you’ll be able to qualify for not just the best loans, but also the best credit cards.

Better credit scores will also give you lower interest rates and the best loan terms.

If you currently have poor credit, don’t lose hope since there are still a few lenderes that are willing to work with you.

For instance, there are many online lenders that are more lenient with credit scores.

These types of lenders focus more on your business’s cash flow and track record rather than your credit.

On the other hand, established companies will have business credit scores. Business credit credit scores usually range from 0 or 1 to 100.

2. Annual Revenue Requirement

There are lenders out there that will only consider applications for businesses that bring in at least a minimum annual revenue.

Lenders will evaluate your revenue to ensure that you have enough cash flow to repay the debt.

The required cash flow will depend on the individual lender.

For instance, online lenders may require $100,000 in annual revenue, while some banks like Bank of America’s minimum cash is $250,000 for secured business loans.

3. Strong Business Plan

Creating a business plan is an essential part of your loan application.

Lenders will also want to look at what your business is doing.

Like how it makes money and how will it continue to succeed so you’ll be able to repay the debts.

And of course, your potential lender would like to know what you plan to do with the funds.

A strong business plan must include the following:

- Executive Summary

- Company Description

- Products and Services

- Market Analysis

- Organization and management

- Product line

- SWOT Analysis (strengths, weaknesses, opportunities, and threats)

- Marketing and Sales Strategy

- Funding Request

- Financial Analysis

- Appendix

However, not all lenders require a business plan. Smaller lenders and

However, only some lenders require a business plan. Some smaller lenders might only need to see proof of enough revenue and stable cash flow to handle the business loan.

4. Time in Business

Lenders are more attracted to businesses that have been in operation for a longer time.

But remember that every lender is unique, and the time requirements will vary.

Traditional lenders may require your business to have at least been operating for two years.

Online lenders, on the other hand, may only require at least six months to a year.

Furthermore, this requirement can vary depending on the type of financing you’re applying for.

For instance, invoice factoring, where you sell unpaid invoices to a factoring company, only requires that you have been in business for at least three months.

5. Collateral or Personal Guarantee

Offering collateral or a personal guarantee can also help the application to get approved.

Collateral is a valued item pledged as a safety net or added security measure to help secure a loan.

It can be equipment, property, businesses, and more.

Loans requiring collateral generally have lower interest rates than unsecured ones.

Moreover, some lenders require borrowers to provide a personal guarantee. This means you’ll accept responsibility for repaying the loan with your own personal assets in case the business is unable to do so.

6. Type of Industry

The type of industry your business is in may also affect your ability to qualify for a loan.

Some lenders deny business loans when the businesses they operate in are considered high-risk.

For example, restaurant industries have very high failure rates.

Other industries that lenders may consider high-risk are:

- Real Estate

- Sales

- Gambling

- Alcohol

- Pharmaceuticals

- Travel Agencies

- Collection services

- Dispensaries

- Cryptocurrency

7. Business and Financial Documents Needed For a Business Loan

If you plan to apply for a small business loan, you must gather all the required documents.

Most lenders will most likely ask for some or all of these documents:

- Personal and business tax returns

- Personal and Business bank statements

- Profit and loss statements

- Balance sheets

- Cash flow statements

- Business licenses and permits

- Business plan

- Employee Identification Number (EIN)

- Proof of collateral

- Commercial lease

- Existing debt schedule

- Legal contracts and agreements

- Financial projections

- Photo of Driver’s License

- Ownership and affiliations

- Legal contracts and agreements

- Articles of Incorporation

To get the exact required list of documents, review your lender’s website or consult with them before applying.

Business Loan Requirements: Summary

When it comes to applying for business loans, remember that every lender is unique and they will have different loan requirements.

Even though not all lenders will ask for all the documentation mentioned above, it’s better to be safe and gather them still.

Most lenders, especially traditional ones, will ask for your personal and business credit scores to assess your creditworthiness.

Other requirements include annual revenue requirements, a business plan, time in business, collateral, the type of industry your business is in, and a few financial and business documents.

It’s best advised that you prepare the documents presented above ahead of time so you won’t be stressed or panic once your lender asks for that specific document.