Credit scores evaluate your likelihood of repaying debt.

If you don’t know what the different ranges of credit scores are and what they mean, then this might be the most important article you’ll read today.

And here’s why:

Knowing the credit score ranges can help you understand the loan or credit card type you’ll get and potentially achieve your financial goals for this year!

Your credit score is crucial when applying for credit as it makes it easier for potential lenders to see whether or not you’re at risk for default.

Here’s why this is important:

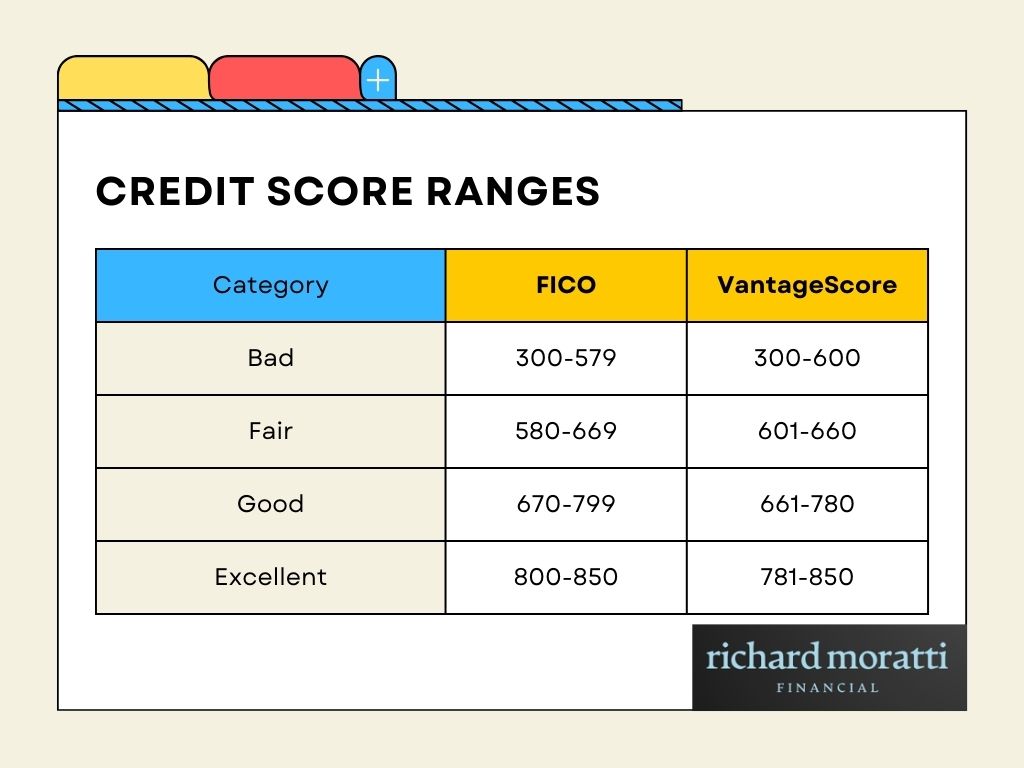

Credit scores fall into four categories: bad, fair, good, and excellent.

However, the two most used and famous scoring models, FICO and VantageScore, have five ranges: FICO score ranges are poor, fair, good, very good, and exceptional.

On the other hand, VantageScore’s are very poor, poor, fair, good, and excellent.

With my 25 years of experience as a bank expert and financial coach, you’ll learn below the different credit score ranges and how they can affect your financial stability.

What is a Credit Score?

Before we differentiate the different credit score ranges, let’s first define a credit score.

A credit score is a three-digit number that represents a borrower’s creditworthiness. Credit scores are used by lenders to evaluate the risk of loaning to a borrower.

Potential lenders consider your credit score when deciding whether or not to approve your loan application. They also review your credit score to set the proper interest rates and loan terms for any credit application.

Generally, credit scores range from 300 to 850, and they are usually divided into five categories: poor, fair, good, very good, and excellent.

Lower credit scores mean that you are more likely to be a risk, while higher ones indicate that you’re responsible and will be able to repay it.

Even though there are different types of credit scores, the two main scoring models are FICO and VantageScore, which both use a 300-850-point credit scoring scale.

What Is The Difference Between the FICO Score and VantageScore?

The FICO score is the most well-known scoring model, and its rival, VantageScore, are the two companies that dominate credit scoring.

Even though they generally both use a credit score range of 300 to 850, they are still different companies with different versions of their scoring calculations.

VantageScore 3.0 and FICO 8 are the most commonly used scoring models today.

However, FICO and VantageScore often move in tandem. If you have a high VantageScore, you most likely also have an excellent FICO score.

Credit Score Ranges: What Are They?

The differences between VantageScore and FICO are minimal since a person with a high FICO score will probably also have a high VantageScore.

In addition, a person with a poor credit score under the FICO scoring model will most likely have a bad credit score in the VantageScore model.

Now, without further ado, here are the different credit score ranges:

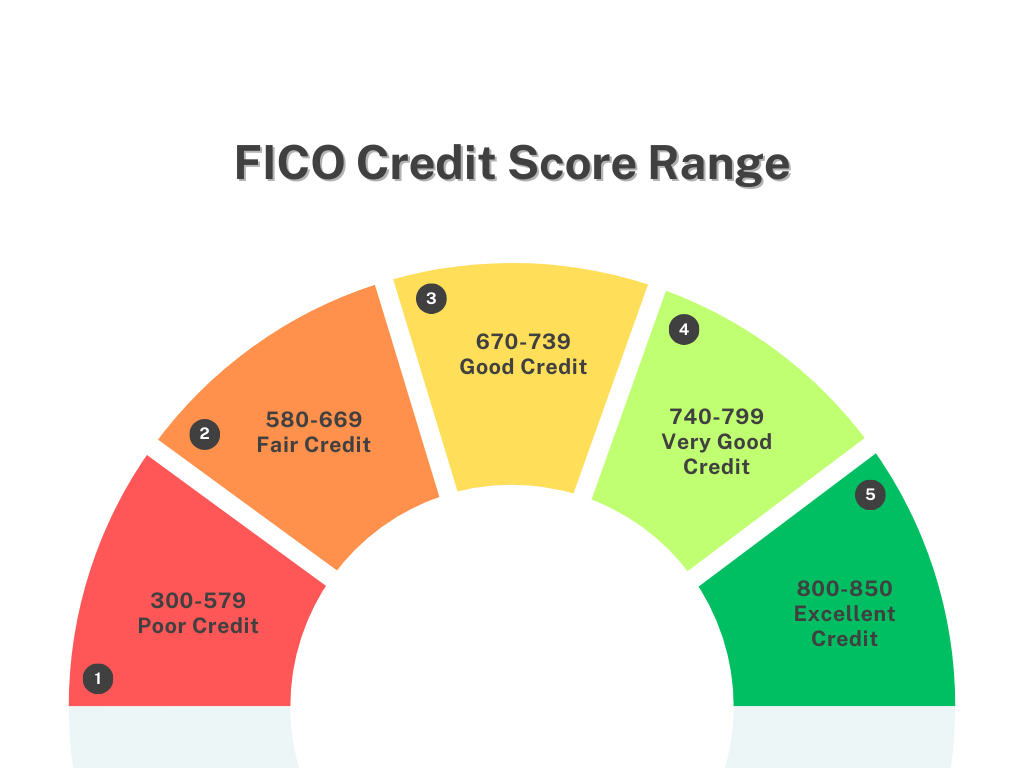

FICO Credit Score Range

FICO score ranges are calculated using a combination of data like payment history, total amounts owed, new credit, and length of credit history. Here are the ranges according to FICO:

- Poor: Less than 580

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

VantageScore Credit Score Range

- Very Poor: 300-499

- Poor: 500-600

- Fair: 601-660

- Good: 661-780

- Excellent: 781-850

What is a bad credit score range?

Credit scores below 580 are generally considered “bad credit.”

If you currently have bad credit, you’ll most likely have difficulty finding lenders (especially traditional ones) who will approve your loan or credit application.

Bad credit will prevent you from getting a business loan, buying a property or vehicle, or opening a credit card.

FICO Score: 300-579

VantageScore: 300-600

What is a fair credit score range?

“Fair” credit scores usually fall between 580 and 669 scores.

A fair credit score makes you more likely to get that loan and credit card approval.

However, not all lenders approve borrowers with this credit score range.

And even if you get approved for your loan, expect higher interest rates than you would if you have a good or excellent credit score.

FICO Score: 580-669

VantageScore: 601-660

What is a good credit score range?

Good credit scores fall around the 670 to 799 range.

A good credit score will give you the power to get that loan and credit card approval.

Good to excellent credit scores show that you’re responsible enough to manage your finances, making you less of a risk for lenders.

This also allows you to get lower interest rates and lenient loan terms.

FICO Score: 670-799

VantageScore: 661-780

What is an excellent credit score range?

Lastly, excellent credit scores range between 781 and 850.

The highest of high credit score shows that you’re an excellent borrower. Potential lenders view you as responsible and trustworthy and would gladly offer loans or lines of credit.

Excellent credit scores can lead to amazing rewards such as 0% introductory APRs on credit cards or 0% car financing.

FICO Score: 800-850

VantageScore: 781-850

How Credit Scores Are Calculated

Credit scores are calculated by reviewing the data in your credit report.

Your credit score reflects your credit history and how you use credit.

Credit scores also tell potential lenders whether you’re a credit risk. Your credit score will increase if you can pay all your bills on time.

Conversely, if you always pay bills late, your credit score will most likely go down.

If you’re wondering how FICO and VantageScore calculate your credit scores, here’s a quick list of the factors that impact your credit score.

Factors That Impact Your FICO Credit Score

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Types of credit (10%)

- New credit (10%)

Factors That Impact Your VantageScore Credit Score

- Payment History – Extremely influential

- Credit Utilization – Highly influential

- Credit age and Mix – Highly influential

- Amount Owed – Moderately influential

- Recent Credit Behavior – Less influential

- Available Credit – Less influential

How to Check Your Credit Score

Checking your credit is free and won’t affect your score.

Most credit card issuers offer a free credit score together with your monthly statement.

Various finance websites offer them whenever you want to see your credit score.

You can also pay to see your FICO score at myFICO, but be aware that you may accidentally sign up for credit monitoring services, which will have monthly fees.

Keep in mind that credit scores can change. If you currently have a bad credit score, it’s in your best interest to improve this score for the betterment of your financial well-being.

How to Monitor Your Credit

It’s also important to monitor your annual credit reports closely, as this can help protect your credit history from errors and signs of fraud.

Check if your information is 100% accurate, complete, and up-to-date.

You can get a free annual credit report at AnnualCreditReport.com. Here, they offer to give you free yearly credit reports from the three credit reporting bureaus: Equifax, Experian, and TransUnion.

However, keep in mind that your credit report will not include your credit score.

Seeing your credit score and monitoring your credit report are two different things.

Reviewing your credit report can help you see how you can improve your credit score.

Different Ranges of Credit Scores: The Bottom Line

Your credit score range tells potential lenders the type of borrower you are.

Knowing the credit score range can help give you a concept of your credit health.

Credit score ranges are based on several factors, such as payment history, amounts owed, credit utilization, and length of credit history.

Credit scores are also used to determine whether you are qualified to borrow money.

Bad credit scores can prevent loan approval. Even if you do get approved, you will most likely face higher interest rates than normal.

On the other hand, people with high credit scores can ask for larger loan amounts since they are not considered risky by lenders.

A good credit score shows you are responsible enough to repay bills on time, giving you access to lower interest rates and better loan terms.