If you’re looking to qualify for a business loan or a new credit card, this might be the most important blog you’ll read today.

And here’s why;

I always say that credit scores can make or break your finances.

When you apply for a loan or any new line of credit, potential lenders and creditors will review your credit score and decide whether or not you will get the business loan, house, or a much-needed car.

While there are several types of credit scores, the FICO® Score is usually the credit scoring model used by most lenders today.

These credit scoring systems, such as VantageScore® and FICO® Score, analyze credit reports to see whether you can repay your debts as agreed.

Credit score softwares uses advanced algorithms to thoroughly evaluate your credit history to know your credit management habits so they can decide how much or how little they can lend you.

With my 25 years of experience as a financial coach and banking expert, this short presentation will show you the biggest factors that affect your credit score and give you a plethora of tips and tricks for quickly raising your credit score so you can achieve your financial goals.

Let’s begin:

5 Factors That Determine Credit Scores

First, what even is a credit score?

For new entrepreneurs or aspiring business owners, a credit score is a three-digit number that lenders use to evaluate the risk of loaning or providing other types of credit to an individual.

For instance, credit card companies, mortgage banks, and auto dealers will review your credit score before deciding whether they’ll lend you money or determine how much they are willing to lend you.

Credit scores can also help potential lenders decide the interest rates and terms of the loan.

Potential lenders might have second thoughts about lending you money if you currently have poor or bad credit. And even if they do, expect higher interest rates and stricter terms.

On the other hand, entrepreneurs with very good credit scores can access higher loan amounts and lower interest rates with lenient terms.

As we discussed above, the FICO credit score, which ranges from 300 to 850, is the most used score among lenders.

Here’s a quick guide on credit score ranges and what they usually mean:

Credit Score Ranges

- Poor: 300-579.

- Fair: 580-669.

- Good: 670-739.

- Very good: 740-799.

- Exceptional: 800-850.

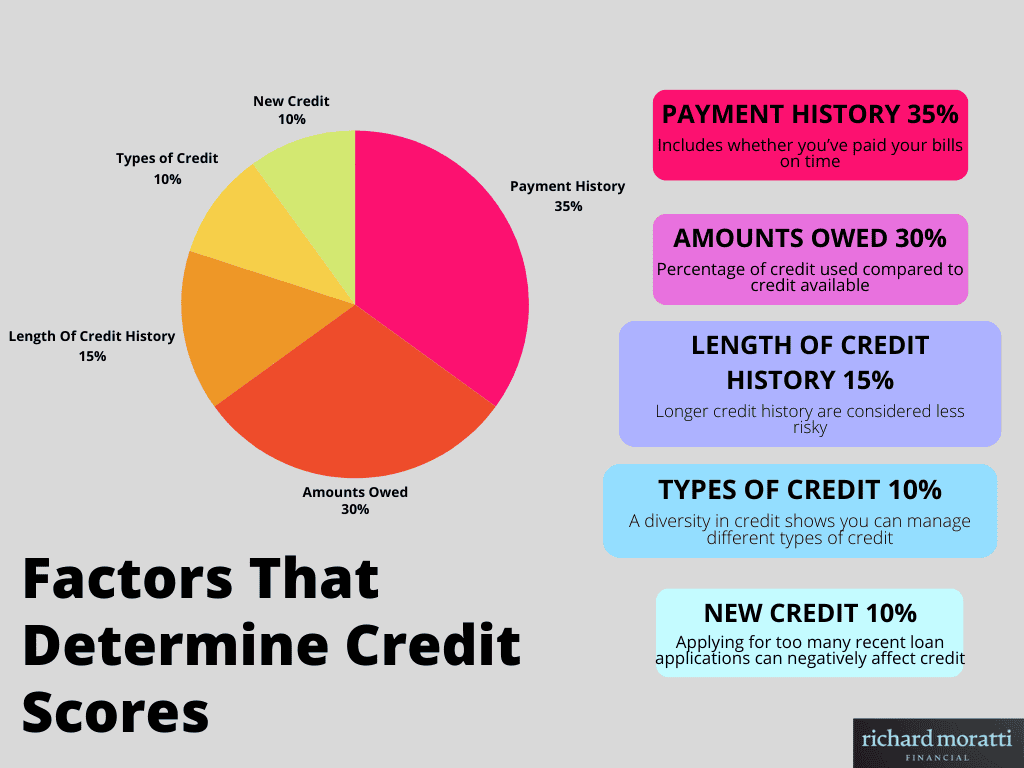

Furthermore, knowing how these scores are calculated can help you improve your current scores. Here are five of the biggest factors that determine your credit score:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Types of credit (10%)

- New credit (10%)

1. Payment history – 35%

Your payment history is the biggest factor in determining your credit score, accounting for up to 35%.

Your payment history shows whether you’re responsible enough to pay your bills on time.

It will also show the number and length of late payments you’ve received (if any).

2. Amouns owed – 30%

Next is the amount owed, which is 30%. It is how much debt you have relative to how much you’ve borrowed; it is called credit utilization tomorrow.

For instance, if your card currently has $5,000 with a $10,000 credit limit, using 50% of your credit limit is wrong.

Keep your utilization well below 30% for the best credit score.

3. Length of credit history – 15%

The amount of time you’ve had the account open in your name is your credit history length. This takes up to 15%.

Let’s say you own a credit card that has been open for a long time.

Continuing to use this card can be a good way to maintain a good credit score since lenders often consider longer credit histories less risky.

FICO scores take into account the age of your longest and newest accounts. They also look at how long your specific credit has been established and how long it has been since you used certain accounts.

4. Credit Mix – 10%

A credit mix or multiple types of credit can help maintain and boost your credit score.

A good credit mix can show lenders that you’re responsible enough to handle different types of credit, such as business loans and installments.

Even though it only makes up 10% of your credit score, it shows you can manage your finances.

5. New Credit – 10%

Your FICO score also considers how many new accounts you have.

Lenders consider new credit as a possible sign that the individual is desperate for credit.

Applying for credit too often can negatively impact your credit score, as lenders usually conduct a hard inquiry when you apply for a new line of credit.

What’s a hard inquiry?

A hard inquiry is reviewing your credit to see if you’re responsible enough to be given credit. It will temporarily lower your credit scores but will bounce back through time and positive reports.

How To Check Your Credit Score

Monitoring your credit score is a great way to maintain it.

If you want to improve your credit score, make it a habit of reviewing it by requesting a free copy of your FICO Score every 30 days via Experian.

You can also check out AnnualCreditReport or the other two big credit bureaus, Equifax and TransUnion, for a free annual credit report.

Knowing your credit score before applying for a new line of credit or business loan can help you determine which products you may qualify for and what interest rates you can expect.

Check for signs of errors or fraud and report them as soon as you find anything, as these misconceptions can negatively impact your credit scores.

How to Improve Your Credit Score

If you’ve recently been denied a business loan, consider improving your credit score before applying again.

A healthy or high credit score can be your key to unlocking higher loan amounts and lower interest rates.

A very good credit score is more attractive to lenders since it tells them you can manage your finances.

Here are some tips to help improve your credit score:

Pay Down Debt

The first thing you need to do is to pay down all your debts.

Paying down debts can help boost your credit score and help in the long run since you’re now less likely to miss any payment deadlines or max out your credit cards.

If you’re really struggling to keep up with your debts, try consulting with nonprofit credit counseling agencies like InCharge Debt Solutions and Money Management International.

These credit counselors can provide a concrete debt management plan to help reduce interest and lower payments.

Lower your utilization

Remember to keep your credit utilization ratio below 30% to make you more attractive to lenders.

Your credit utilization ratio measures how much of your available credit you’re using.

Lenders will be able to tell if you’re responsible enough to manage your finances without maxing out credit cards.

Make On-Time Bill Payments

Payment history is the biggest factor that impacts a credit score.

And if you cannot pay your bills on time, it will reflect on your credit scores.

Improving your credit history means you’ll have to pay all your debts on time.

Late payments are a huge turn-off for lenders, so it’s important to make a habit of repaying debts on time.

Here are a few tips to help you pay bills on time:

- Install an Auto-Pay

- Learn your billing cycle

- Organize paper bills

- Use calendar reminders to keep track

- Stick with a budget that works

- Ask lenders to adjust due dates

- Try Debt Management Plans

Get a Credit Builder Loan

Credit builder loans are a good opportunity to improve your credit scores if you can pay all your bills on time.

Opting for a credit builder loan will open an account in your name where lenders deposit your approved loan amount and report your payments to the credit bureaus.

This type of loan is an installment plan with fixed monthly payments. It typically has low spending limits and high-interest rates.

Paying these bills on time will help you boost your credit score since lenders are reporting your good payment history to your designated credit bureaus.

Don’t Open Unnecessary Credit

Opening multiple unnecessary accounts at once can negatively impact your credit score since it can tell lenders you’re desperate for credit, making you seem risky to creditors.

Having multiple active accounts will also make managing and tracking payment due dates more difficult, resulting in late payment bills and a decrease in your credit score.

Don’t always apply for new credit since it will appear on your credit report.

My advice is to use the credit you’ve already established. It shows that you’re committed and responsible in managing your finances, which will help boost your score.

Factors That Determine Your Credit Score: Summary

A credit score represents the creditworthiness of an individual.

A good or high credit score means you’ll get approved for loans with the best interest rates and less strict terms.

However, how do these credit bureaus calculate our credit scores?

Let’s consider your FICO score, lenders and creditors’ most commonly used score.

The FICO score places heavier importance on your payment history (35%) and credit utilization or amounts owed (30%).

It also considers the length of your credit history (15%), the types of credit you have (10%), and whether you recently opened a new account (10%).

All of these factors can have a huge impact on your credit scores.

Knowing these key factors can help you be a better entrepreneur and boost your credit score.