Do you currently have a 600 credit score?

If the answer is yes, then you might be wondering… Is that good or bad?

Will that be enough for me to get the car or the business loan I want to get so I can scale my business and finally relax?

If you’re not sure about what a 600 credit score means and whether it’s enough to prevent you from getting that loan or whatever you would like to get, then this might be the most important article you’ll come across today.

Having a credit score that falls within the range of 580 and 668 is categorized as fair credit.

While a 600 credit score won’t disqualify you from getting different types of credit, improving it is still in your best interest.

Boosting your fair credit score to an excellent one is the key to unlocking the best loan terms and lowest interest rates.

With my 25 years of experience as a finance coach and banking expert, I’ll show you a much closer look at what a 600 credit score means.

Below, you’ll also learn various credit types that you can apply for and tips on how to improve your credit score.

How are Credit Scores Calculated?

Before we define your 600 credit score, let’s first understand how credit scores work.

The two main credit-scoring companies, FICO and VantageScore, use data from your credit reports to evaluate your credit scores using their own credit-scoring models.

Each company is unique and will have different scoring models, which makes your credit scores differ depending on which credit-scoring company calculated them.

Here’s how FICO and VantageScore generally calculate your credit score:

Factors That Influence Your FICO Credit Score:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Types of credit (10%)

- New credit (10%)

Factors That Influence Your VantageScore Credit Score:

- Payment History – Extremely influential

- Credit Utilization – Highly influential

- Credit age and Mix – Highly influential

- Amount Owed – Moderately influential

- Recent Credit Behavior – Less influential

- Available Credit – Less influential

Keep in mind that each credit-scoring company has different credit-scoring models.

They may also use various data from different credit reports. So, don’t panic if your FICO score differs slightly from your VantageScore.

Is 600 A Good Credit Score?: Different Credit Score Ranges

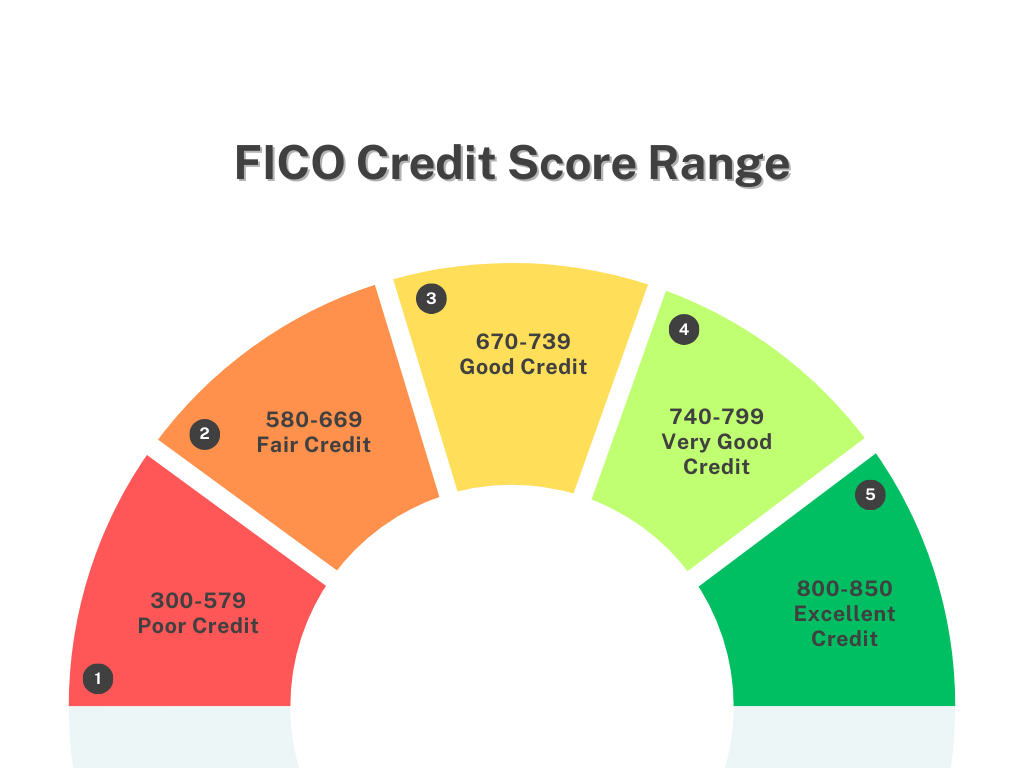

FICO credit scores range from 300 to 850, and they are usually divided into five categories: poor, fair, good, very good, and excellent.

And if you currently have a 600 credit score, your score is categorized as “fair credit.”

Having fair credit means that some lenders might consider you a high-risk borrower.

But don’t worry! That doesn’t necessarily mean you won’t get that loan approval.

A higher-than-average revenue, low outstanding debts, and a trustworthy employment history can help lenders look past your credit score.

Nowadays, certain loans and specific lenders will help you get that loan or credit. However, expect to have higher interest rates than normal.

As we’ve tackled earlier, each credit-scoring company differs in its own credit score ranges.

Here’s a quick guide on FICO and VantageScore credit score ranges:

FICO Credit Score Range

- Poor: Less than 580

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

VantageScore Credit Score Range

- Very Poor: 300-499

- Poor: 500-600

- Fair: 601-660

- Good: 661-780

- Excellent: 781-850

How to check your credit score

Checking your credit score is free and won’t impact your credit score.

Many credit card issuers offer a free credit score along with your monthly statement.

You can also pay to see your FICO score by visiting myFICO.

It’s best advised to monitor your credit closely to track your progress and ensure that your credit reports have no errors or signs of fraud.

Monitoring your credit is also a great way to improve or boost your credit score since inaccuracies can cause scores to drop.

You can get a free credit report from each of the three major credit bureaus at AnnualCreditReport.com

What Can You Get With A 600 Credit Score?

Having a good or excellent credit score can help you easily get approved for various types of credit.

If you currently have a 600 credit score, here are a few things you should know about getting different types of loans:

Can I get a personal loan with a 600 credit score?

Getting a personal loan with a 600 credit score would still be possible. Again, a 600 credit score falls into the “fair credit” score range.

If you currently have lower credit scores, expect to have high interest rates and less favorable loan terms. Some loans may also require you to have a co-signer to get approved.

Fortunately, even poor credit scores can still qualify for a loan. But that solely depends on the lender. Can I get a car loan with a 600 credit score?

There’s no universal minimum credit score required when it comes to getting a car loan.

However, just like in most loans, having a good or excellent credit score can help you get that loan approval with the best loan terms and lower interest rates.

Can I get a mortgage with a 600 credit score?

The credit score range you’ll need to buy a house will depend on various factors, such as the type of mortgage you apply for.

Usually, you’ll need a credit score of at least 620 to get a conventional loan. And similarly to the ones above, a higher credit score can help you secure lower interest rates.

If you plan to get a mortgage backed by the Federal Housing Administration, you generally need a credit score of at least 500 to qualify.

If your credit score is below 580, you will most likely be required to pay at least a 10% down payment.

But if your credit score is above 580, expect only to pay a downpayment as low as 3.5%.

Fortunately, a mortgage backed by the Department of Veterans Affairs has no minimum credit score required.

Lastly, a minimum credit score of 640 is required to qualify for USDA-backed loans.

How to improve your 600 Credit Score: From Fair to Good

Fortunately, credit scores are not static. Credit scores will change depending on how well you manage your credit.

There are plenty of benefits to having a high credit score, like having insurance discounts, better insurance rates, higher credit limits, better loan terms, easier credit approval, and more.

Here are a few tips for you to improve your 600 credit score from fair to good.

Consistently pay bills on-time

One of the easiest ways to boost your credit score is by consistently paying your bills on-time.

Remember that payment history is the biggest factor that influence your credit score, which makes late payments a big no-no if you want to boost your credit score.

Unable to consistently repay your bills on time can result to a massive drop that can impact your finances for years.

Here are a few tips that can help you if you’re struggling to repay your debts on time:

- Install an AutoPay

- Make Calendar Reminders

- Make a budget that works for you

- Ask lenders to adjust due dates

- Consult Debt Management Plans

Lower your Credit Utilization Ratio

Keeping your credit utilization low is another way to boost your credit scores.

Reduce your utilization ratio below 30% to make you more attractive to lenders. Having a low utilization ratio tells lenders that you’re responsible enough to manage finances by not maxing out your credit.

Use a secured credit card

Getting a secured credit card is another way to improve your credit.

A secured credit card is backed by a cash deposit. You’ll need to pay it upfront, and the amount deposited is usually the same as your credit limit.

Using a secured credit card is like using a normal credit card. Repaying these payments on-time will help improve your credit.

Ask for higher credit limits

When you get approved for a higher credit limit, your balance stays the same, and now it instantly lowers your overall credit utilization.

You’ll get a better chance of getting your credit limit higher when you’re income has increased and you have had a positive credit experience for the past few years.

However, before you make this request, ensure that you already have good spending habits and do not max out extra available credit.

Is 600 A Good Credit Score: Final Thoughts

A 600 credit score is often referred to as fair or poor credit.

However, that doesn’t necessarily mean it’s impossible for you to get that credit.

A credit score of 600 can also be considered good, depending on the type of loan you’re getting and the lender. Each lender has different standards. And the qualifications for one lender may differ from others.

However, it’s still practical to improve your credit scores if you’re currently in the poor to fair range.

A high credit score which ranges above 700 can unlock better loans or credit and can get you better terms, and the best interest rates.

Consistently paying your bills on time, lowering your credit utilization, using a secured credit card, and asking for a higher credit limit can help improve your credit score.