Do you currently have a 750 credit score?

But what does this score mean?

Can you finally get approved for that loan?

Or maybe get that credit card you’ve always wanted.

If you’re wondering whether having a 750 credit score is enough to get the best credit and loan deals, then this might be the most important article you’ll read today.

And here’s why;

With over two decades of experience as a financial coach and banking expert, today, I’ll show whether a 750 credit score is enough to qualify you for loans and other types of credit.

A 750 credit score is often classified as Very Good or Good, depending on the credit scoring model used.

This score range is often approved for better mortgage, loan, and credit card offers and rates.

Better stick with me, as I’ll further show you tips on how you can improve your credit score so you can achieve even better deals.

While having excellent credit shows good signs that you’re responsibly managing your finances, it’s still important to learn what goes into credit scores to maintain your hard-earned credit.

What Does A 750 Credit Score Mean? Good Or Bad?

Credit scores are important factors when applying for credit.

A credit score is a three-digit number representing your creditworthiness. It’s calculated based on data from the major credit bureaus (Equifax, Experian, and TransUnion).

If you currently have a 750 credit score, your score range might differ slightly on what scoring model was used to calculate it.

A credit score can be considered “excellent” by one scoring model, such as FICO, but it can slightly differ when used by another scoring model, like VantageScore. Both scoring models have different methods of calculating credit scores.

Here’s a quick rundown on both company’s credit score range:

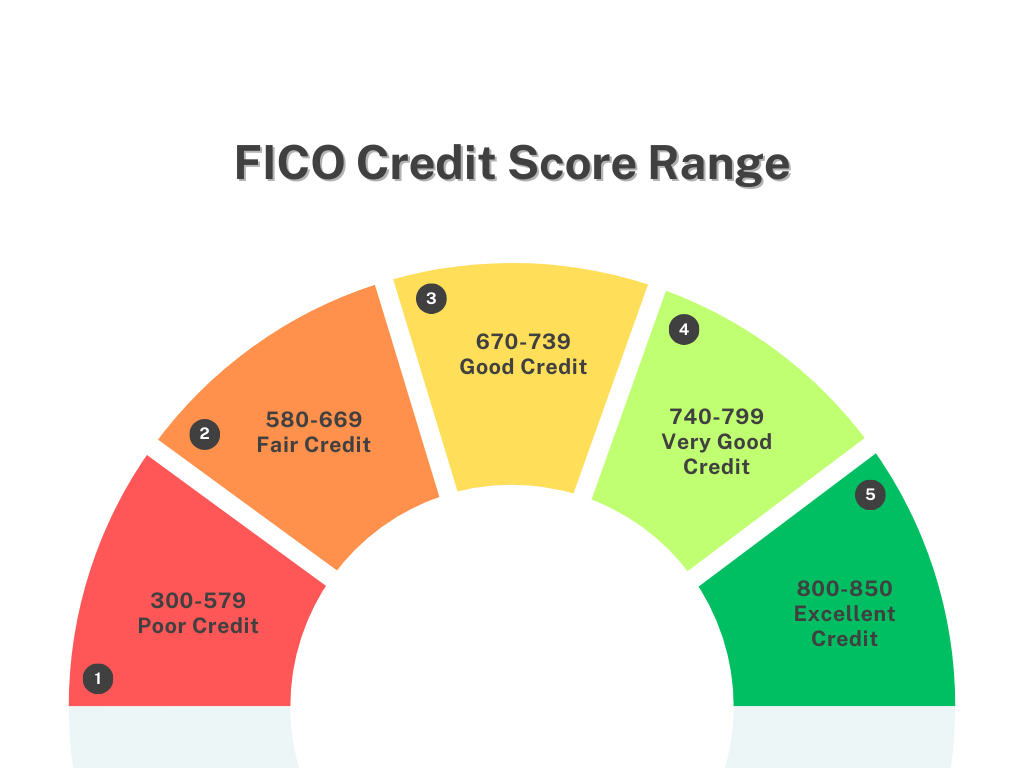

FICO Credit Score Range

- Exceptional: 800+

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: Less than 580

VantageScore Credit Score Range

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very poor: 300-499

FICO scores in the 740 to 799 range are considered “very good.”

Is 750 a good FICO credit score?

As discussed earlier, FICO credit scores range from 300 to 850. According to FICO, scores between 740 and 799 are classified as “very good.”

Did you know that a 750 credit score is slightly above the average credit score from last year? As of last year, 2023, the national average FICO score was 717.

Is 750 a good VantageScore credit score?

Similarly to FICO, VantageScore credit scores also range from 300-850.

However, with VantageScores, if you have a credit score of 750, you won’t be classified in the “very good” range.

Because in VantageScores, credit scores that range between 661 and 780 are considered “good” scores.

And according to Experian, about 38% of Americans have a “good” VantageScore credit score.

What will you get approved for with a 750 score?

Credit scores above 800 are classified as “excellent” or “exceptional,” but a credit score of 750 can still open you up for some of the best rates for loans, mortgages, credit cards, and more.

A 750 credit score will usually get you approved for most financial products. The only thing that will differ will be the terms you’ll receive.

Here are a few products that will get you approved with a 750 credit score:

Loans

Taking out a personal loan or an auto loan will be easier for you with a 750 credit score.

You should encounter no issues of being approved by potential lenders since they see you as responsible and creditworthy.

Having a “very good” credit score can also help you get the lowest interest rates from lenders.

If you want to know more about loan interest rates, I recently wrote an article about the factors that affect them, which you should definitely check out!

Mortgages

Another product that you should have an issue getting is mortgages.

If you plan to buy a new home, lenders consider many factors before lending you money, such as your monthly income, debt-to-income ratio, and, of course, your credit score.

However, if you currently have a FICO score of 750, you shouldn’t face any problems being approved for a mortgage.

Rentals

If you recently want to move to a new apartment, landlords will still look at their client’s credit scores.

Even though most landlords don’t usually have a standard credit score when deciding about your rental application, however, it’s highly unlikely that landlords will decline your application when you have a 750 credit score.

Other Things You Can Do With a 750 Credit Score

- Lower Interest Rates— A 750 credit score qualifies you for lower interest rates on loans and other types of credit.

- Bigger Loan Amounts—A very good credit score makes you more attractive to potential lenders and credit card issuers, who might also offer larger loan amounts and more financial flexibility.

- Amazing Insurance Rates—Insurance companies may use credit scores to evaluate your risk. A 750 credit score can unlock better insurance rates.

How Can I Get A 750 Credit Score?

Even though you’re currently categorized in the “very good” credit score range, this doesn’t mean you should stop building or maintaining your credit.

It’s best advised to strive for the best credit possible to unlock the best deals possible.

I don’t necessarily mean that having a 750 credit score isn’t enough, but there is always room for improvement.

Here are a few tips that can help boost your credit score even higher:

Always Make Payments On Time

Five factors determine a credit score:

- Payment History (35%)

- Amounts Owed (30%)

- Length of Credit History (15%)

- New Credit (10%

- Credit Mix (10%)

As you can see above, payment history is the most crucial piece of your credit score.

That means missed payments can damage your credit scores significantly for years!

Consistently making your payments on time helps build and maintain your very good credit score.

If you’re having difficulty repaying bills on time, you can opt for AutoPay.

Install an AutoPay

Setting up an AutoPay can help you never miss payments again.

Most credit card companies offer this setup for your card’s minimum, statement, or total balance.

Also, if you still have other bills to pay, you can use Cash App and set up your AutoPay there.

Lower Credit Utilization Ratio

Your credit utilization ratio shows the amounts owed compared to your total credit limit.

Potential lenders and credit card issuers love when people use their credit responsibly.

For instance, let’s say you have a credit limit of $10,000 and you currently have an outstanding balance of $7,500; your utilization ratio is 75%, which is high.

A great rule of thumb is to get your utilization ratio below 30%.

Don’t Open Multiple Unnecessary Accounts

The length of credit history takes about 15% of your credit score.

To further improve your credit history, avoid opening multiple unnecessary accounts. Instead, stick to your main one.

Also, applying for too much credit can hurt credit scores since lenders will do a hard inquiry, temporarily lowering credit scores.

Opening too many accounts at once can also give lenders a negative impression as they may think you’re desperate for credit, making you a higher risk.

Is 750 A Good Credit Score: Final Thoughts

A 750 Credit Score is a great score to have! If you’re looking at your FICO score, a 750 credit score says you’re in the “very good” range.

On the other hand, if we’re considering your VantageScore, a 750 credit score falls into the “good” score range.

Either way, this credit score can get you the best rates on loans, mortgages, and credit cards.

You might be satisfied with this high score right now, but it’s always best to aim for a higher credit score.

Working hard to maintain and build your credit score and finally seeing it above the 800 mark will be such a joyful feeling.

Continue making payments on time, lower your credit utilization, and avoid opening unnecessary credit, which are three of the best ways to boost credit even more.

Keep working on your credit to unlock all your financial dreams.