If you’re struggling to find the perfect business loan that matches your credit score, this might be the most important article you’ll read today.

In this article, you’ll learn the minimum credit score for different types of business loans.

Applying for a business loan can be difficult and confusing, especially if you don’t know what you are doing.

Sadly, not all business owners get that loan approval.

And it’s usually because of having a poor credit score, cash flow limitations, and a lack of collateral.

So what’s the solution?

Let’s find out:

One of the biggest factors lenders consider when approving loans is the borrower’s credit score.

Credit scores help lenders further evaluate your eligibility for funding and can also impact the type of loan you are getting, interest rates, and loan terms.

Higher credit scores of 700 and above will get you more pleasing terms and lower interest rates.

Even though getting a business loan with scores as low as 500 is still possible, lower credit scores will make it difficult to qualify for business loans.

Personal Credit Scores

Most lenders will review your personal credit to determine if you’re qualified for a business loan.

Lenders favor individuals with good credit scores because it tells them they are responsible and trustworthy enough to repay the loan.

The FICO credit score is the most commonly used among consumer lenders. It ranges from 300 to 850.

Here’s a quick guide on credit score ranges and what they usually mean:

Credit Score Ranges

- Poor: 300-579.

- Fair: 580-669.

- Good: 670-739.

- Very good: 740-799.

- Exceptional: 800-850.

These scores are based on data collected by three major credit bureaus: Equifax, Experian, and Transunion.

However, even though they differ in the data gathered, some factors help determine or calculate a credit score.

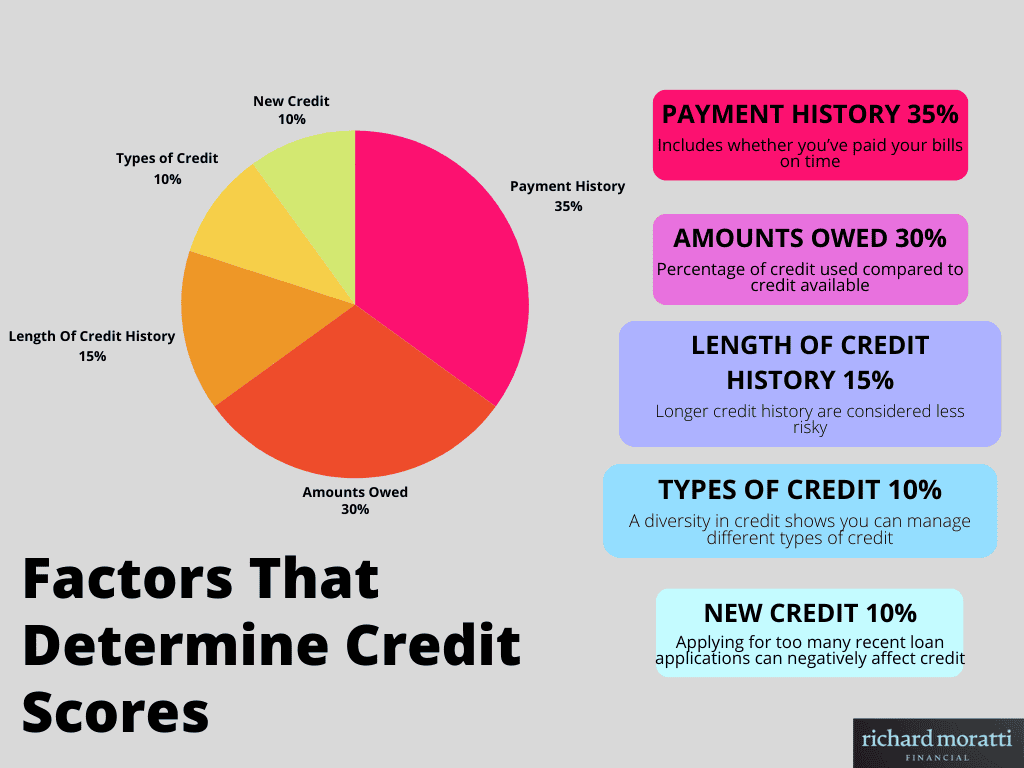

Factors That Determine Credit Scores

Below are five categories that determine credit scores:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Types of credit (10%)

- New credit (10%)

As you can see above, payment history and amounts owed are the most significant factors when calculating a credit score.

That’s why it’s crucial to pay your bills on time and keep your debt lower than your available credit.

Business credit scores

Lenders may also review your business credit score when you apply for a business loan.

Similarly to personal credit, business credit scores represent the business’s creditworthiness.

However, business credit scores range from 0 to 100, with 0 being a high risk and 100 representing a low risk.

It is generated by credit bureaus like Dun & Bradstreet, Equifax, and Experian

Minimum Credit Score Requirement by Lender Type

Nowadays, there are various lenders out there that can help finance your small business or startup.

However, every lender is unique and may differ in their minimum credit score requirements.

Below is a short guideline for you to consider when exploring different lenders.

- Banks and credit unions: Traditional banks and credit unions are more strict about lending. You’ll need a credit score of 680 or higher to qualify. A good credit score will increase your chances of getting approved for larger loans.

- SBA lenders: A minimum credit score of 600 is needed to qualify for an SBA loan.

- Online lenders: Many online lenders don’t require a good credit score. Some lenders accept scores even as low as in the 500s, especially if the business has good financial health. However, these loans may have higher interest rates and stricter loan terms.

Minimum Credit Score By Business Loan Type

If you’re relatively new to the financing world, you should know that there isn’t a standard minimum credit score needed for all business loans.

However, although some lenders don’t require a minimum credit score, most will evaluate it when deciding whether to work with you.

Remember that a strong personal credit score can be key to unlocking that business loan.

Credit scores not only determine your eligibility for the loan, but they can also determine the loan terms, loan amount, repayment schedules, and more.

Of course, there are still other requirements that can impact your loan, such as your business credit score or annual revenue, but your personal credit score is one of the most significant factors in determining your business loan.

Here’s a breakdown of minimum credit score requirements by business loan type:

| Type of Business Loan | Minimum Credit Score Requirement |

| Term Loan | Banks and credit unions usually require a minimum of 670 or above. Online lenders, however, may require only 500. |

| Line of Credit | Like term loans, bank and credit union minimums start at 670 or higher, while online lenders only require a score of 580 or higher. |

| Commercial Real Estate Loans | A stronger credit score is needed for commercial real estate loans, ideally 680 or higher. |

| SBA Loan | SBA Loan lenders typically require a minimum score of 620-680. |

| Equipment Loan | Minimum starts at 520 to 550. |

| Invoice Factoring | Usually, they have no credit score requirement. |

| Merchant Cash Advance (Business cash advance) | Considered a risky credit loan, lenders here only require a minimum credit score of 500. |

How to Increase Your Credit Score

If you struggle to get approved for a business loan, consider boosting your credit score before applying.

A healthy credit history and a strong credit score will get you the best loan with low-interest rates and lenient terms.

Here are some tips to help improve your credit score:

Monitoring Credit Report

Inaccuracies like missing accounts, wrong Social Security Numbers, or wrong credit limits can negatively affect your credit score.

Monitoring your credit report regularly is one way to improve your score.

Check for errors or signs of fraud, and then report them to the credit bureaus if there are any.

Check out AnnualCreditReport to get a free report and analyze it thoroughly.

Lower your utilization

Your credit utilization ratio measures how much of your available credit your business is using.

Lowering your utilization ratio below 30% makes you more attractive to lenders. It shows that you’re responsible enough to manage your finances without maxing out credit cards.

Make On-Time Bill Payments

Boosting your credit history means you’ll have to pay all your debts on time.

Late payments are a huge turn-off for lenders, so make it a habit to pay all your bills on time and in full.

As we’ve tackled earlier, payment history is the biggest factor when determining a credit score.

Unable to pay debts on time can cause your credit score to drop heavily.

If you’re having trouble paying your debts on time, here are tips that can help you:

How do I pay bills on time?

- Install an Auto-Pay

- Make Calendar Reminders

- Stick with a budget that works

- Ask lenders to adjust due dates

- Try Debt Management Plans

Get a Credit Builder Loan

When you get a credit builder loan, it will open an account in your name where lenders deposit your approved loan amount and report your payments to the designated credit bureaus.

This type of loan is an installment plan that has fixed monthly payments.

Paying these bills on time will help you boost your credit score.

Minimum Credit Score For A Business Loan: Final Thoughts

There’s no specific credit score that can guarantee your loan approval. However, a higher credit score can help increase chances.

Lenders favor business owners who have very good personal credit. But remember that some lenders also check your business credit score.

Before applying for a loan, consider learning about other requirements and improving your credit score first.

Don’t settle for the minimum credit score to get that loan approval. A high credit score offers plenty more benefits for your business, such as lower interest rates, various rewards, higher loan amounts, and more.