If you are applying for credit cards or you are looking to get your first auto loan or buy a house or an apartment then this might be the most important article you are ever going to read…

And here’s why:

Did you know all the good things I listed above, like your dream car or your new apartment, start with your initial credit score?

That’s why it is very important that you begin to build your credit history and credit score when you first start your path to riches.

An excellent credit score can be the main key to unlocking your desired life and achieving your financial goals.

But what credit scores do you start with?

First, let me say this: People don’t really begin with the same credit scores.

Why?

Because every person has different spending habits.

With my 25 years of experience as a financial coach and bank expert, below, you’ll not just learn about what your credit score starts with, but I’ll also show you a few tips on how to build and start maintaining your credit.

So let me tell you about what credit scores you start with and why responsibly using credit is crucial from day one.

What Credit Score Do You Start With?

Every individual will have a unique and different credit journey. Everyone does not begin with the same credit score. There’s no one standard number everyone will start with.

Credit scores also vary depending on the credit scoring model, which is FICO or VantageScore.

When you first start your credit journey, you won’t start with a zero score—you simply won’t have a score at all.

That’s because your scores will not be calculated until a lender or another commodity requests them to see your creditworthiness.

All you need to do is to responsibly establish your credit to help get the best score possible.

How Are Credit Scores Calculated?

While credit scores vary depending on the credit score model used, most of the top lenders use FICO scores. Here are five factors that determine your credit scores:

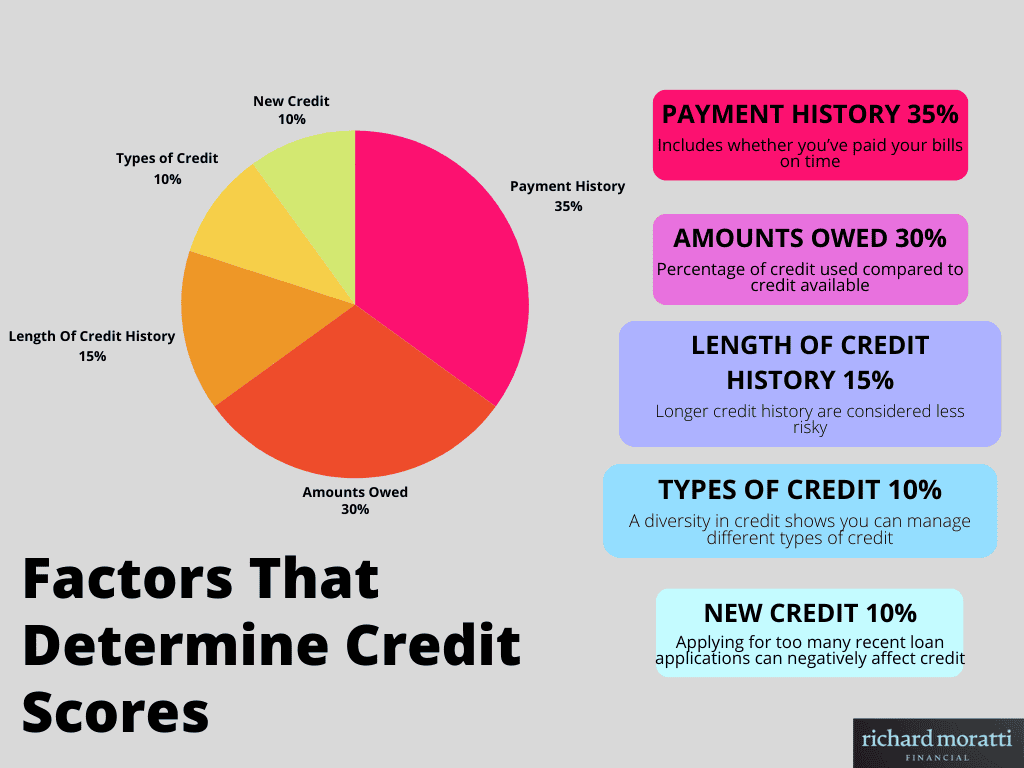

The categories FICO uses to calculate your credit score include:

- Payment History (35%): Payment history shows a record of whether you pay your credit on time.

- Amounts Owed (30%): Amounts owed, also known as credit utilization, is the amount of money you owe compared to your available credit.

- Length of Credit History (15%): The longer your credit history, the more potential lenders will consider you a creditworthy individual.

- New Credit (10%): It also factors in the number of recently opened accounts and the number of hard inquiries on your credit report.

- Credit Mix (10%): Having many types of credit can show that you are capable of handling your finances.

Credit score ranges

A credit score is a three-digit number representing your creditworthiness, usually ranging from 300 to 850.

As we’ve tackled earlier, the two credit-scoring companies that are usually used are FICO and VantageScore. Here’s how both companies categorize credit scores:

FICO Credit Score Range

- Exceptional: 800+

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: Less than 580

VantageScore Credit Score Range

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very poor: 300-499

How long does it take to build credit from scratch?

Since you’re just about to start, you might be wondering how long it takes to build good credit from scratch.

Generally, it can take three to six months to get your first credit score.

However, the time it takes to build credit will differ for everyone.

It depends on factors such as how you manage debt, credit utilization, and more.

Building credit does not happen overnight. You’ll need plenty of patience since building credit from scratch can take at least six months.

Let’s use FICO as an example.

FICO requires that an individual have at least one credit account open for six months or more and one active account reported to the credit agencies within the past six months.

Fortunately, one account can meet both of those requirements.

The third requirement in FICO is that there should be no sign on your reports that you are dead.

Once you’ve completed all the requirements, you can continue improving your credit score.

How long does it take to build a 700 credit score?

When looking at FICO scores, a 700 credit score is considered good.

And since the average credit score in the U.S. is 715 in 2023, it’s definitely achievable.

However, it will take at least six months of having positive credit habits before you can attain a 700 credit score.

Fortunately for you, there are a few steps that you can take to help increase your credit score, which will be tackled later, so keep reading!

How to check your credit score

Before applying for new credit or loans, it’s best to check your credit score first.

Credit scores are one of the most important factors in determining whether or not lenders will approve your application.

By checking your credit beforehand, you won’t make the mistake of applying for credit cards specifically designed for people with excellent credit scores.

Of course, people with good to exceptional credit scores will have more chances of getting approved and getting the best terms with lower interest rates.

But don’t worry; every lender is unique, and some may have different qualification requirements than others.

If you’re new to credit, strive for the best credit score possible to get the best deals.

If you want to check your credit scores, many banks and credit card issuers offer you access to your credit scores for free.

Some free credit score services can provide you with your VantageScore instead of your FICO score.

How To Check Credit Reports

Remember that checking your credit score and your credit reports are different.

If you want to monitor your credit report, you can get free copies of your reports from all three major credit bureaus—Equifax, TransUnion, and Experian at AnnualCreditReport.com.

Monitoring your credit is one of the easiest and best ways to help improve your credit.

Check for signs of fraud or inaccuracies since both can cause damage to your credit score.

How to Build and Maintain Credit Scores

If you’re new to credit, you’ll also know how to start building your initial credit score.

Here are a few ways you should follow to build and maintain your credit:

Get a Secured Credit Card

Getting a secured credit card is one of the best ways to build your credit score.

Secured credit cards require a cash deposit. They’re one of the most recommended cards for people with low to fair credit scores.

Responsibly using a secured credit card can help boost your credit score quickly.

Become an Authorized User

Becoming an authorized user of a family’s credit card account can help increase your credit scores.

In this way, you don’t need to open your own card. Instead, you’ll ask a person you trust (a family member or close friend) to add you to their existing account.

Consider a Credit-builder loan

You can also opt for credit-builder loans. These types of loans may not require good credit for approval, but they will demand that you have enough income to pay bills. When applying for a credit builder loan, you may need to give details about your employment history, income, and balance.

What Credit Score Do You Start With?: Summary

Credit scores don’t start at zero.

If you’re starting your credit journey right now, it will probably start somewhere in the middle, and once you’ve seen your score, you can start building it from there.

Since you’re starting from scratch, it’s important to establish good credit to help meet all your financial goals.

To do this, you must consistently pay bills on time, lower credit utilization, monitor your credit, and more.

Building excellent credit can set you up for the best credit card deals and loans.

Remember that even if there’s no such thing as a “starting credit score,” you still have control over where your credit score ends up.