Picture this: You’re finally able to buy your dream car or move to a new house when, out of nowhere, you realize that suddenly, you have a bad credit score, leaving you in a state of shock and not knowing what to do.

Trying to get a loan or open a new line of credit with a bad credit score is like trying to swim with weights tied to your ankles.

Poor credit can haunt you for years, making it tough to rent a better apartment, get a sweet car deal, or even land your dream job.

But don’t worry!

With over 25 years of experience as a financial coach and banking expert, I will not only reveal to you the range of bad credit scores, but I’ll also arm you with tips on how you can improve your poor credit so you can buy whatever you need.

By reading my content and with a little bit of work you can become financially savvy in no time, and you can definitely flip the script on your credit scores.

But before we dive all the way into bad credit scores, you must first learn the different credit scoring ranges and how credit scoring models calculate your credit scores.

Read on, and let’s get right into it!

What Is Considered A Bad Credit Score?

Lenders see people with bad credit as a big risk, making them hesitant to work with them.

So, what is considered a bad credit score?

Well, you must first understand that lenders use two main credit scoring models: FICO and VantageScore.

While most lenders use FICO than VantageScore, there’s still a slight difference in

credit score ranges.

Generally, a FICO score below 580 or a VantageScore of less than 601 is considered a bad credit score.

If your score falls in the bad credit range, you’ll face less favorable results with lenders. And even if they approve your application, expect higher interest rates and stricter terms.

But you don’t need to live with bad credit. Stick with me; later on, I’ll show you the best tips to help improve your credit scores.

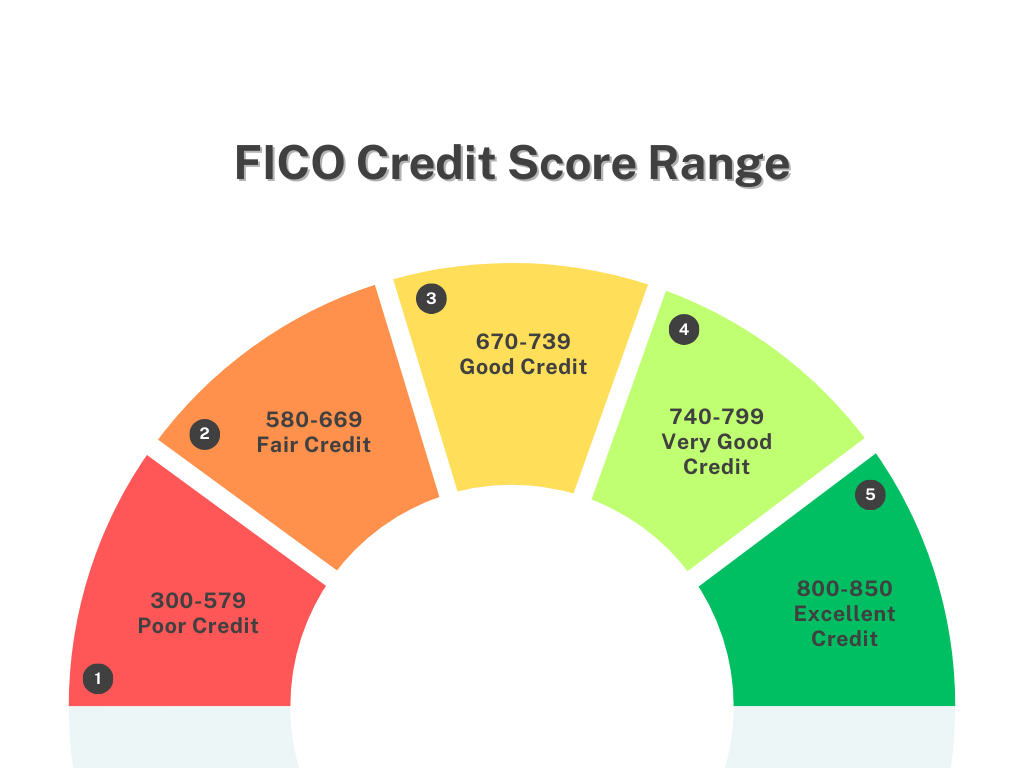

On the other hand, here’s a quick look at the different credit score ranges:

FICO Credit Score Range

- Exceptional: 800+

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: Less than 580

VantageScore Credit Score Range

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very poor: 300-499

As you can see above, there’s still a small difference in scores.

The question now is how these credit scoring models calculate our credit scores.

Here are five factors that help FICO determine your credit scores:

How Are Credit Scores Calculated?

- Payment History (35%): Payment history shows a record of whether you pay your credit on time.

- Amounts Owed (30%): Amounts owed, also known as credit utilization, is the amount of money you owe compared to your available credit.

- Length of Credit History (15%): The longer your credit history, the more potential lenders consider you a creditworthy individual.

- New Credit (10%): This calculation also factors in the number of recently opened accounts and hard inquiries on your credit report.

- Credit Mix (10%): Many types of credit can show you can handle your finances.

What Causes Bad Credit?

To be able to fix bad credit scores, we must first understand and find the root of the problem.

Bad credit doesn’t happen all of a sudden. Credit scores don’t drop without any reason.

Bad credit is usually the result of bad financial habits that make you unable to repay debts on time and consistently.

I recently wrote a separate article about the most common mistakes that lower credit scores, and I encourage you to check it out!

A few common mistakes that can cause your scores to drop are:

- Maxing out credit cards

- Closing old credit cards

- Opening too many accounts at once

- Ignoring your credit

- Living beyond your means

How Bad Credit Scores Can Affect You

Keep in mind that every situation is different. However, bad credit scores can affect your life more than you think.

Here are a few examples where a higher credit score is more beneficial:

Denial of Credit Application

Since lenders view borrowers with bad credit as a risk, lower scores can hinder you from getting that much-needed loan or credit card.

Traditional lenders or banks usually have stricter qualification standards for their various financial products, making it difficult for anyone with a bad credit score to qualify.

Higher Interest Rates and Less Favorable Loan Terms

Having bad credit doesn’t automatically disqualify you from all products.

In fact, plenty of lenders (usually online lenders) still work with people with low credit scores.

However, interest rates or annual fees will be higher compared to applicants with good credit.

Loan terms will also be less favorable to people with bad credit since lenders see you as an irresponsible borrower.

Harder Time Renting An Apartment

Did you know that landlords may also run credit checks on potential tenants?

When landlords check your credit, they won’t see your credit score.

Still, they can review your credit report, which shows your payment history, collection accounts, and other information to help them decide whether to rent you the apartment.

Typically, landlords approve a lease for applicants with better credit.

Limited Employment Opportunities

When applying for a new job, employers may review your credit report (with your written authorization) as part of the hiring process.

However, some states have laws that restrict the use of credit information in the employment process.

Limited Credit Card Options

Having bad credit can limit your credit card options.

It will decrease your chances of qualifying for cards with no fees and higher credit limits.

But remember that lenders and credit card issuers don’t look at your credit scores. They can also use your income or monthly housing payments to help determine your qualification for the product.

How to Improve Your Bad Credit Score

If you’ve recently been denied a business loan, consider improving your credit score before applying again.

Here are some tips to help improve your credit score:

Lower your Credit Utilization

Remember to keep your credit utilization ratio below 30% to make you more attractive to lenders.

Keeping your credit utilization low makes you more attractive to lenders.

A low utilization ratio tells lenders that you’re responsible enough to manage your finances without maxing out your credit.

Make On-Time Bill Payments

Payment history is the biggest factor determining your credit score, as it takes up 35% of your FICO score.

Paying bills consistently on time is crucial when boosting your credit score.

Multiple missed or late payments can hurt your credit score for over seven years.

Get a Credit Builder Loan

A credit builder loan is designed or focused on building credit.

With a credit builder loan, you must make fixed payments for 6-24 months. Your money is also saved in a savings account until the end of the loan term.

Lenders will report your great payment history to the credit bureaus, which will help strengthen your credit score.

Don’t Open Unnecessary Credit

Opening too many unnecessary credits at once can damage your credit scores.

FICO and VantageScore also consider your credit inquiries when calculating your scores.

Lenders can still deny credit to people who have recently opened too many accounts, even if the individual has a high credit score.

What Is Considered A Bad Credit Score: Summary

Getting a bad credit score is like getting a big fat F on your school report card.

It’s definitely not a good look.

According to the FICO scale, bad credit scores range below 580, while the VantageScore scale says bad credit is less than 601.

Bad credit scores can be a big wall that stops you from getting your dream job.

It can also limit your qualifications to various financial products like loans, credit cards, etc.

It’s crucial to start building your credit as early as possible to get that sweet car loan or move to a much better apartment.