Did your credit score have an unexpected drop?

Then this might be the most important article you’ll read today…

And here’s why:

Did you know that a sudden drop in your credit score is something you need to avoid at all cost if you want to get your dream car or move to a much better apartment?

There are many possible ways on why your credit score dropped.

Some of them are actually pretty common mistakes, such as missing due dates or closing a credit card.

However, reasons can be more complicated than that.

Stick with me; with over two decades of experience as a financial coach and banking expert, you’ll learn below the likely reason for your credit score’s sudden drop and how to fix it.

Your scores will change as soon as there’s a new update on your credit report.

And sometimes, scores may update more frequently, making it harder for you to see that your score is slowly decreasing.

Remember that credit scores will not change for any reason.

Below, we’ve compiled a list of the most probable causes of the sudden drop in your credit scores.

Let’s start, shall we?

8 Reasons Why Your Credit Score Suddenly Dropped

But before we discuss the different reasons why your score is dropping, you must first learn the various credit score ranges.

You must also first understand how credit scores are calculated, as it can help you identify what’s causing your score to drop in the future.

Credit scores will vary on the credit scoring model used.

The two most commonly used, FICO and VantageScore, slightly differ in credit score range.

Here’s a quick look at the different credit score ranges:

FICO Credit Score Range

- Poor: Less than 580

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

VantageScore Credit Score Range

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very poor: 300-499

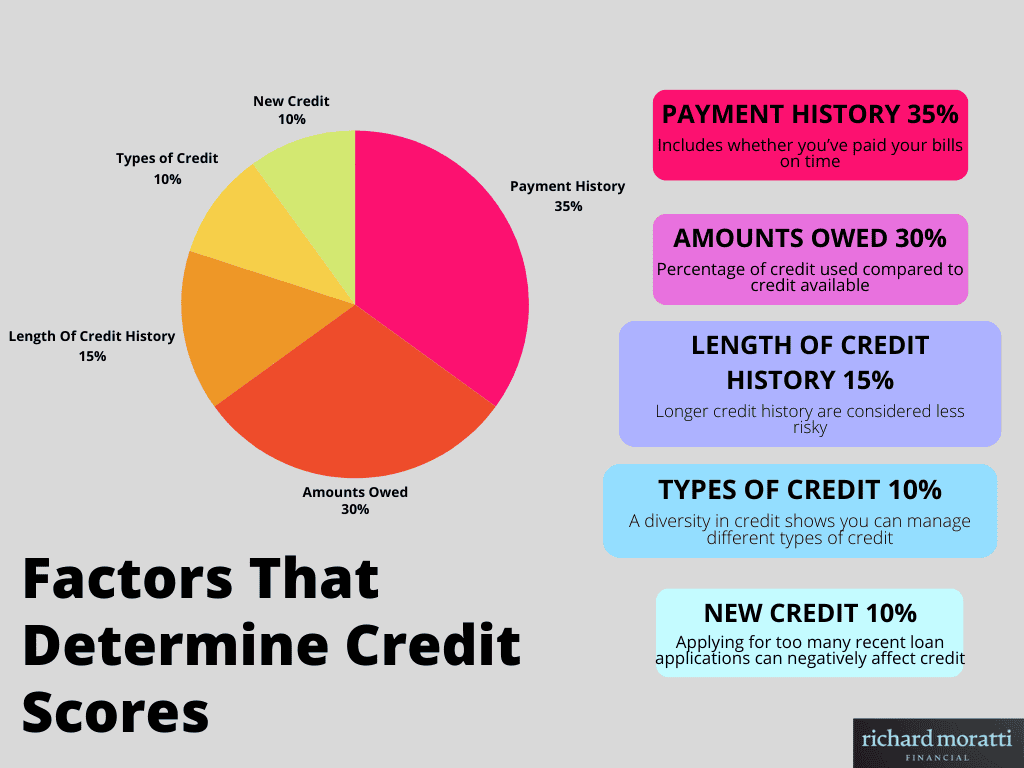

Factors That Determine Credit Scores

Now,, let’s take a look at how credit scoring companies like FICO calculate your credit scores.

Learning how your scores are evaluated gives you a better idea of how to improve them the next time.

Here is how FICO scores are calculated:

- Payment history (35%): Payment history shows whether you’re responsible enough to pay your bills on time consistently.

- Amounts owed (30%): The amount owed, or your credit utilization ratio, is the amount of debt you have compared to the amount you’ve borrowed.

- Length of credit history (15%): Your credit history length shows the amount of time you’ve had the account open in your name.

- Credit mix (10%): Owning multiple types of credit can also help improve your credit score.

- New credit (10%): Your scores will be affected by how many new accounts you have. If you’re always applying for new credit, lenders might see this as the individual is desperate for credit.

1. You Missed a Payment

Most lenders use the FICO Score credit scoring model.

According to FICO, payment history is the biggest contributing factor to credit scores, accounting for about 35% of them.

Even one late payment can negatively impact your score and can remain in your report for years to come.

Payments that are 30 days past due will be reported to the three major credit bureaus by the credit issuers, resulting in a decrease in your score.

Payments past due for 60 to 90 days will have an even bigger drop in your score.

If these debts are not paid, the credit issuer can send your debts to a collection agency.

Record of late payments in your account will remain in your credit file for seven years.

Make sure to consistently pay all your bills on time to strengthen your credit score.

2. You Bought Something Expensive

Credit cards are great tools to buy large or unexpected expenses.

However, making a big purchase on your credit can increase your credit utilization, resulting in a drop in your credit score.

For instance, let’s say you have a credit limit of $10,000 and you currently have an outstanding balance of $7,500; your utilization ratio is 75%, which is high.

Amounts owed are the second most crucial factor when calculating credit scores.

It’s best advised to keep your credit utilization below 30%.

3. You Recently Applied for New Credit

When you apply for a new line of credit, lenders first conduct a background check to determine your creditworthiness.

They’ll decide based on your payment history, credit utilization, and other types of accounts you currently have.

Credit issuers will conduct a hard inquiry or a soft inquiry, temporarily lowering your credit scores.

When you authorize someone to check your credit history, a hard inquiry is documented on your credit report.

4. One of Your Credit Limits Decreased

Similarly to buying something expensive or maxing out credit cards, your credit utilization ratio can increase when your credit limit decreases, which can cause a sudden drop in your credit scores.

Let’s say your credit limit was $10,000, and you currently owe $3,000. That would make your utilization ratio at 30%.

Unfortunately, if your credit issuer lowers your credit limit to $6,000, your credit utilization ratio suddenly changes to 50%, which can cause a drop in your credit scores.

5. You Closed a Credit Card

Do you really need to close credit cards you don’t use?

Well, in some instances, like when trying to rebuild credit, it may be best to keep them open since closing a credit card account will increase your utilization ratio and reduce the length of your credit history.

Keep in mind that the length of credit history counts for 15% of FICO scores, making it more beneficial for your credit scores.

If your credit card has a high annual fee that you can’t afford right now, by all means, close it.

But also remember that keeping an account open will not hurt your credit. Just ensure that you maintain your credit limit and credit history.

6. There Is Inaccurate Information on Your Credit Report

Monitoring credit reports is one of the easiest ways to ensure there are no mistakes on your credit report.

Even though it’s rare, mistakes can still happen, and inaccurate credit reports are still possible.

Incorrect information on credit reports, such as incorrect personal data or inaccurate payment histories, can lower your scores.

Report it immediately if you find something inaccurate in your credit report.

Inaccuracies on your credit report can also be a sign of identity fraud.

7. Identity Fraud

A quick sudden drop in your credit score can even be caused by something you didn’t do.

You may have become a victim of identity theft, which is no joke, and millions of families suffer from it every year.

Your credit scores can massively decrease when someone uses your identity to apply for different kinds of credit.

To fight fraud, you need to act as quickly as possible. Report a fraud alert on your credit profile with one of the major credit bureaus as soon as possible.

After reporting to the credit bureaus, you should complete an identity theft report and submit it to the Federal Trade Commission (FTC).

In this instance, freezing your credit can be helpful since it will deny lenders access to your credit file.

8. Pay down debt

Finally paying off a loan or a debt, whether a personal loan, mortgage, or car, can give any person so much happiness and relief.

However, paying down your debts has a downside, as it can lower your credit scores.

Credit scoring companies love to see a mix of credit and revolving credit on your report.

If you pay off a loan or a mortgage, it will be removed from your credit mix, causing your credit score to drop.

Ways to Improve Your Credit Scores

If your credit scores suddenly drop, many ways can help you get back on the right track.

Here are a few tips on how to improve your credit scores:

Pay your bills on time

One of the easiest ways to boost your credit score is by consistently paying your bills on time.

Remember that payment history is the biggest factor influencing your credit score; making late payments a big no-no if you want to boost your credit score.

Unable to consistently repay your bills on time can result in a massive drop that can impact your finances for years.

Here are a few tips that can help you if you’re struggling to repay your debts on time:

- Install an AutoPay

- Make Calendar Reminders

- Make a budget that works for you

- Ask lenders to adjust due dates

- Consult Debt Management Plans

Minimize Utilization Ratio

Keeping your credit utilization low is another way to boost your credit scores.

Reduce your utilization ratio below 30% to make yourself more attractive to lenders. A low utilization ratio tells lenders that you’re responsible enough to manage your finances without maxing out your credit.

Regularly Monitoring Your Credit

Did you know that inaccuracies on your credit report can negatively impact your credit score?

Make it a habit to monitor your credit to ensure that all information is accurate. Check for errors or signs of fraud.

You can get free copies of your credit reports from the major credit bureaus: TransUnion, Equifax, And Experian at AnnualCreditReport.com.

Avoid Applying For Unnecessary Credit

Applying for too much credit at once can hurt your credit scores, as lenders will conduct a hard inquiry, lowering your credit scores.

Trying to open too many credit accounts can also give lenders a negative impression. They might think you’re desperate for credit.

Consider a Secured Credit Card

Consider choosing a secured credit card if you’re in the low to fair credit score range.

Secured cards need a security deposit to open the account, which is typically easier to approve. Using a secured credit card responsibly can help boost your credit score quickly.

Reasons Why Your Credit Score Suddenly Dropped: Summary

Credit score fluctuations are normal and should be expected since our credit reports are constantly updated when we buy something or repay something.

Credit scores can decrease when you’ve missed payments, increased your utilization ratio, closed a credit card, recently applied for unnecessary credit, and more.

However, a massive drop in your scores can be caused by something more serious.

For instance, it can be caused by identity theft.

That’s why checking your credit reports regularly is crucial to avoid identity fraud or any inaccuracies in your report.